Leading Factors to Pick VA Home Loans for Your Following Home Acquisition

Wiki Article

Navigating the Home Loans Landscape: Exactly How to Leverage Funding Solutions for Long-Term Wealth Structure and Safety And Security

Navigating the intricacies of home lendings is vital for any person looking to build wide range and make sure monetary protection. Understanding the different types of financing options available, along with a clear evaluation of one's economic scenario, lays the foundation for informed decision-making.Recognizing Mortgage Types

Home lendings, a vital component of the actual estate market, can be found in various kinds designed to satisfy the varied demands of consumers. The most typical types of home finances include fixed-rate mortgages, variable-rate mortgages (ARMs), and government-backed finances such as FHA and VA car loans.Fixed-rate mortgages supply stability with consistent regular monthly settlements throughout the lending term, typically varying from 15 to 30 years. In comparison, ARMs feature interest prices that fluctuate based on market problems, usually resulting in lower initial settlements.

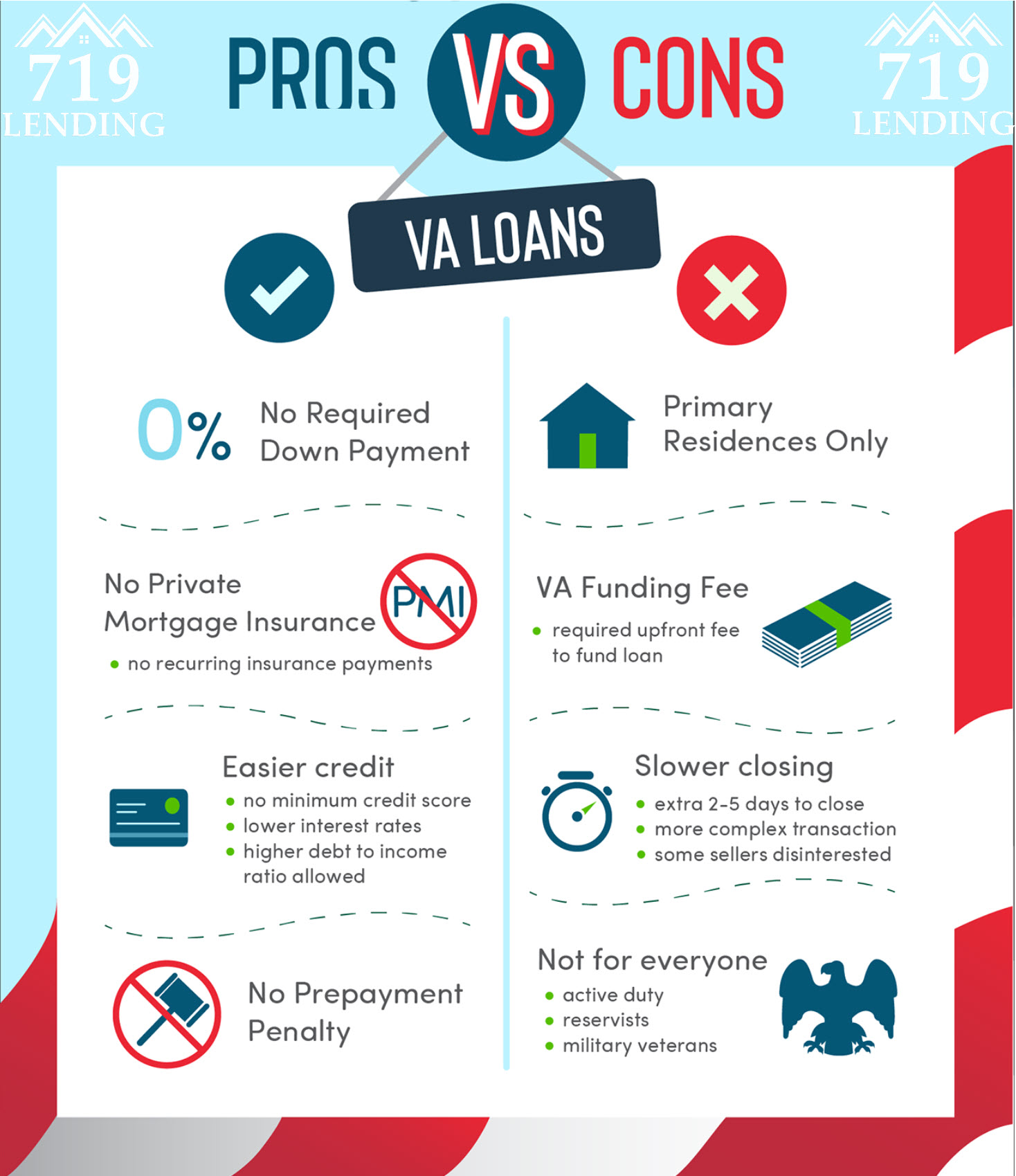

Government-backed financings, such as those guaranteed by the Federal Real Estate Management (FHA) or assured by the Division of Veterans Matters (VA), provide to details groups and frequently need reduced deposits. These loans can promote homeownership for people that might not receive standard funding.

Assessing Your Financial Scenario

Examining your economic circumstance is an essential step in the home mortgage process, as it lays the structure for making informed loaning decisions. Begin by analyzing your earnings resources, including wages, benefits, and any extra revenue streams such as rental residential properties or financial investments. This detailed sight of your profits helps loan providers establish your loaning capacity.Following, evaluate your expenses and regular monthly responsibilities, including existing financial obligations such as charge card, pupil financings, and vehicle payments. A clear understanding of your debt-to-income proportion is crucial, as most loan providers prefer a ratio listed below 43%, ensuring you can handle the new mortgage payments along with your existing commitments.

Furthermore, evaluate your credit report, which dramatically affects your car loan terms and rate of interest. A higher credit rating shows economic reliability, while a lower rating may demand strategies for enhancement prior to requesting a finance.

Last but not least, consider your possessions and savings, including emergency funds and liquid financial investments, to ensure you can cover deposits and closing costs. By diligently assessing these parts, you will certainly be better placed to browse the home financing landscape successfully and secure financing that straightens with your long-term monetary objectives.

Techniques for Smart Borrowing

Smart borrowing is important for navigating the intricacies of the home finance market efficiently. A strong debt rating can substantially lower your interest prices, equating to considerable cost savings over the life of the lending.Following, consider the sort of home mortgage that finest additional info fits your financial situation. Fixed-rate financings supply stability, while variable-rate mortgages may supply reduced first repayments yet carry dangers of future rate increases (VA Home Loans). Evaluating your lasting strategies and financial capability is essential in making this decision

Additionally, objective to protect pre-approval from loan providers prior to home searching. This not just provides a more clear photo of your spending plan however also enhances your negotiating placement when making a deal.

Long-Term Wide Range Building Methods

Building lasting riches with homeownership requires a tactical strategy that goes past merely securing a home loan. One effective method is to consider the appreciation potential of the property. Selecting homes in expanding communities or locations with intended growths can result in considerable rises in building value with time.An additional essential facet is leveraging equity. As home mortgage settlements are made, property owners develop equity, which can be used for future financial investments. Making use of home Home Page equity lendings or lines of credit score carefully can offer funds for additional realty investments or restorations that better enhance home worth.

Additionally, maintaining the home's condition and making critical upgrades can considerably contribute to long-term wealth. When it comes time to sell., straightforward renovations like energy-efficient appliances or up-to-date shower rooms can yield high returns.

Lastly, recognizing tax benefits connected with homeownership, such as mortgage passion deductions, can improve economic results. By making best use of these benefits and adopting a proactive investment way of thinking, house owners can cultivate a robust portfolio that promotes long-term wide range and security. Ultimately, an all-around approach that prioritizes both residential or commercial property option and equity management is essential for lasting wide range building through real estate.

Maintaining Financial Security

Additionally, fixed-rate home loans offer foreseeable regular monthly payments, making it possible for much better budgeting and financial planning. This predictability safeguards property owners from the changes of rental markets, which can cause abrupt boosts in housing costs. It is vital, nonetheless, to ensure that mortgage repayments continue to be convenient within the broader context of one's monetary landscape.

Furthermore, responsible homeownership involves routine upkeep and renovations, which secure property worth and boost total safety. Property owners ought to also think about diversifying their economic portfolios, making certain that their investments are not solely tied to property. By combining homeownership with various other financial tools, people can produce a well balanced technique that reduces risks and boosts general monetary security. Inevitably, keeping monetary safety through homeownership requires a aggressive and educated approach that emphasizes cautious preparation and ongoing persistance.

Conclusion

In final thought, successfully browsing the home car loans landscape demands an extensive understanding of various finance types and an extensive assessment of specific monetary situations. Implementing calculated borrowing techniques assists in long-term wide range buildup and safeguards monetary stability.Navigating the intricacies of home finances is necessary for anybody looking to develop wealth and make sure financial safety and security.Examining your monetary scenario is an important step in the home lending process, as it lays the structure for making educated loaning Read Full Report choices.Homeownership not just serves as a vehicle for long-lasting wealth structure but likewise plays a considerable duty in preserving economic safety. By integrating homeownership with various other monetary instruments, people can create a well balanced method that mitigates risks and improves overall financial security.In verdict, effectively browsing the home finances landscape demands a thorough understanding of different loan kinds and a thorough evaluation of individual monetary scenarios.

Report this wiki page